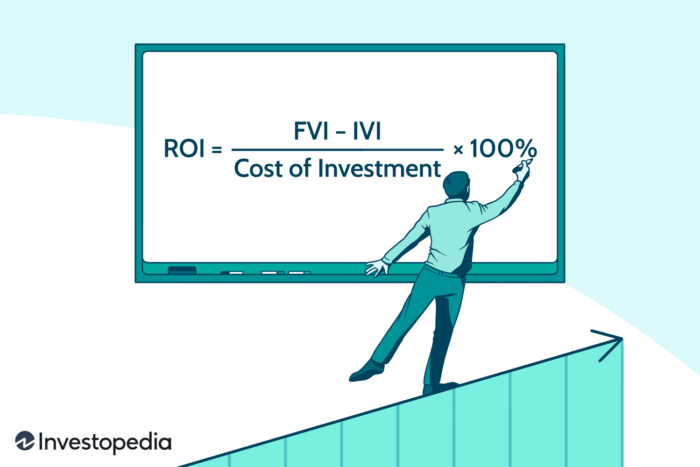

Return on Investment is commonly used by all types of businesses. In fact, the most important and crucial indicator of the health of a business is ROI. An organization can use it to gauge the returns that you get from your business venture. It is the only way to find out the direction you are heading in business. Return on investment simply refers to a formula that one can use to determine the progress of a business. ROI is a ratio as a percentage of the profit you get from the business and the total cost of investment. The ROI tool also compares two or more business enterprises. It thus a good measure of the company in relation to its competition as it can be expressed as a percentage.

Return on investment (ROI) also referred to as Profit from Investment alludes to a notable monetary measurement. Generally, investors use it to dissect the monetary outcomes which emerge from a business person’s investments as well as actions. There exist other changing metrics that are essentially known by a similar definition. In any case, the most famous alludes to a metric used to find out how well a business enterprise is doing, which is ROI.

Uses of the ROI

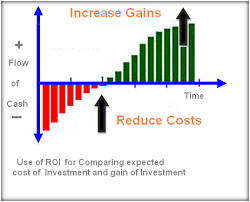

Often utilized as a Cash flow metric, the Return on Investment especially makes an evaluation of the scale. Just as the planning of investment gains, which are directly linkable to the scale and schedule of costs as well. In any circumstance where the ROI apparently posts a high rate, it suggests that the additions which one makes compare well with the costs that had been brought about by the venture. This simply means that the income matches well with the expenditure.

Returns from an Investment have developed into a notable idea in the previous few decades for the most part as a generally useful measurement for examining capital accomplishments, business activities, and moderate financial ventures. Investors coordinate these investments into stock shares or into venture funding use.

The issue of ubiquity, however, is not of much significance since individuals can use the metric without truly understanding the benefits and setbacks that are related to it. Profit from Investments is utilizable when trying to gauge how productive a transaction is now and again. This definition is exceptionally exact just as vital.

There are business managers who utilize various measurements in financial aspects rather than ROI to suggest the very same thing. Such use is possibly off-base and needs knowledge since productivity is a word that comparatively characterizes a measure. The measure shows returns by utilizing not very many differing monetary measurements like Internal Rate of Return (IRR), and Return on Capital Employed among others.

Significance of ROI

The inherent significance of the metric, Return on Investment, is fairly in its name. Return on Investment helps in responding to questions such as, what is accomplishable for what one spends. Do the profits expected to outperform the costs in question, and do the profits achieved impeccably legitimize the costs utilized? Numerous kinds of ROI measure what one can acquire from a specific expense through a specific calculation.

Additionally, individuals utilize some ratios some of the time. Regularly, a result that is more than 0.00 infers that profits overweigh costs while a Return on Investment. This suggests that it is inclusive of costs that enormously outperform the profits. At times certain plausible activities effectively compete for finances and other conveying components between the alternative options are reasonably the same. In such cases, the venture or activity that had a more noteworthy degree of ROI is the ideal decision to invest or spend more money in.

Decision-making based on ROI

The utilization of ROI is vital. It is very useful for the decision-makers. In fact, it is important for such decision-makers to remember that an ROI measure all alone is not a satisfactory ground for choosing an investment. It does not hold enough reason to choose one venture or activity over an alternate one. The ROI, which one may determine for an expected activity is not completely reliable. It neglects to say anything concerning the odds that anticipated returns just as expenses occur as expected.

This suggests, the Return on Investment all alone doesn’t make reference to anything concerning the certainty of risk. It just portrays how one can estimate the profits against the expenses. That is if the results one expects can become a reality. Owning up to this truth is very important. A shrewd business analyst will attempt to survey the odds of shifting ROI results. Likewise, a more astute business analyst’s main career is settling on investment choices. Such a person will make a thought of both the scale and dangers related to these measurements consistently.

In addition, the business decision-makers will expect a reasonable proposition from analysts too. This often concerns how ROI might be improved by reducing expenses, adding gains, or accelerating gains. While examining a budget summary, experts for the most part measure the monetary health of a business just as the idea of activities that go on.

Other Monetary Performance Metrics

Considering this, there are a few estimates that one may include and are normally called ROI too. They are Return on Capital Employed, Return on Total Assets, Return on Equity, and Return on Net Worth. Also, in different situations where the accentuation is mostly on the assessment of income. ROI now and again is employable to point at the total income results for a given time period.

Moreover, there are people who insist that other investment metrics are ROI. The average rate of return is one of the primary measurements. The internal rate of return is the subsequent measurement. By basically dissecting how to utilize the terms, an alternate sort of ROI that gauges the bundles of money utilized for more prominent investments can refer to as the cash-on-cash assessment or just the profit from contributed capital.

Conclusively, there are numerous Returns on Investment measures that are generally utilizable in a business. The terminology lacks a solitary definition on its own that is similar worldwide. This implies that when making an audit of the measures of ROI, or when even a business requires one to concoct one, it is necessary to take care and ensure that all individuals involved can portray the measure in a similar way.

Categorised in: General

This post was written by Cynthia Njoki

Please Subscribe and get Notified when new articles are posted