Introduction

Chamas, the informal savings and investment groups, have proven to be more than just a means of saving money. They can also serve as a powerful vehicle for financing business ventures and entrepreneurial dreams. In this article,we’ll learn How to use chamas to finance business ventures and explore the strategic steps to leverage Chamas for funding your business ideas and achieving your entrepreneurial goals.

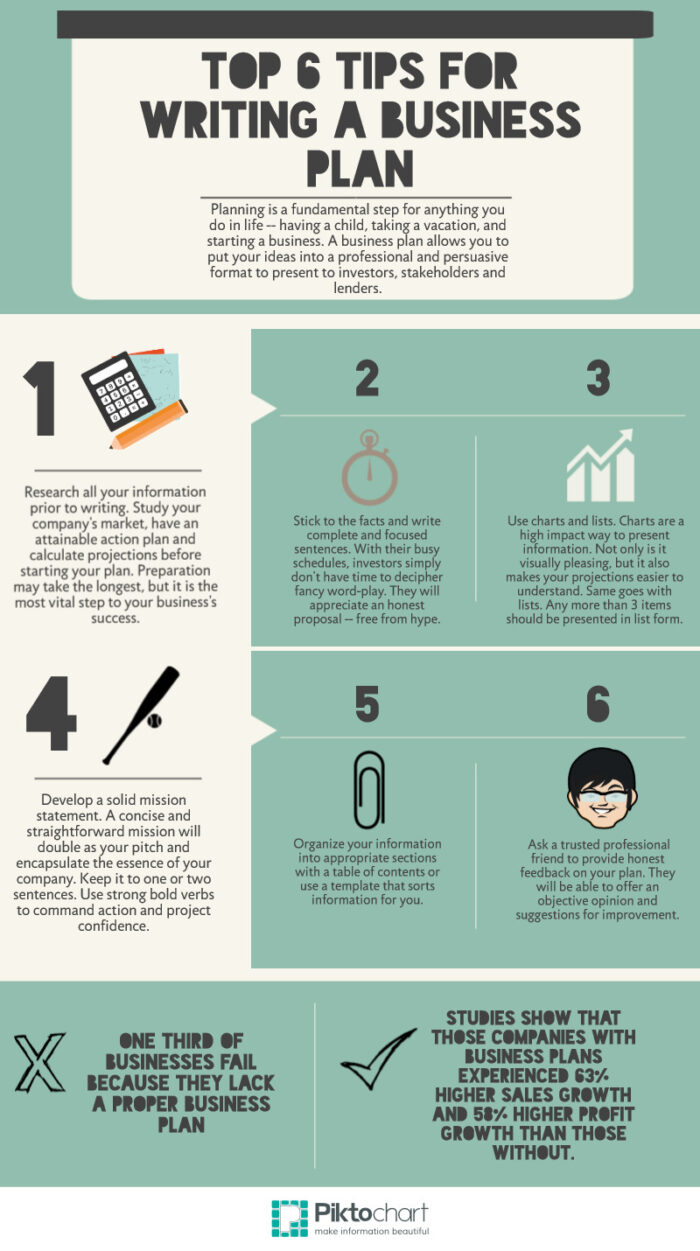

Formulate a Solid Business Plan:

Before seeking Chama funding, it’s essential to have a well-structured business plan. Your plan should outline your business idea, goals, revenue projections, and strategies for success. A thorough business plan demonstrates your commitment and professionalism to potential Chama investors.

Identify Chamas with Business Interests:

Not all Chamas are the same; some are specifically focused on supporting entrepreneurial endeavors. Seek out Chamas with a history of investing in businesses or those that align with your industry or vision.

Network and Build Relationships:

Networking is a crucial aspect of gaining Chama support. Attend Chama meetings, workshops, and events to establish relationships with Chama members. Building trust and rapport is essential when seeking financial backing.

Present Your Business Idea:

Once you’ve identified a Chama interested in business ventures, present your business idea with enthusiasm and clarity. Highlight the potential for profitability, social impact, and how their investment can benefit the group.

Outline Investment Terms:

Clearly define the terms of the investment. Specify the amount of funding required, the expected return on investment, and the timeline for repayment or profit-sharing. Transparency is key to securing Chama support.

Offer Collateral or Guarantees:

To enhance the appeal of your business venture to Chamas, consider offering collateral or guarantees that safeguard their investment. This can provide added security and confidence to potential Chama investors.

Address Risk and Mitigation Strategies:

Chamas are cautious investors. Be prepared to discuss potential risks and how you plan to mitigate them. A well-thought-out risk management strategy can instill confidence in Chama members.

Provide Regular Updates:

After securing Chama funding, maintain open communication with Chama members. Provide regular updates on the progress of your business venture, financial performance, and any challenges faced.

Honor Commitments:

Meeting financial obligations and honoring the terms of the investment agreement are crucial. Building a reputation for reliability can open doors to future Chama investments.

Consider Social Impact:

Many Chamas prioritize ventures that not only promise financial returns but also contribute to the community or society. Highlight the social impact of your business to appeal to Chama investors with a broader vision.

Conclusion:

Chamas offer a unique opportunity to finance business ventures while fostering a sense of community and collaboration. By following these strategic steps, you can effectively tap into Chama resources and turn your entrepreneurial dreams into reality. Remember that Chamas thrive on trust, transparency, and shared goals, making them ideal partners for your business endeavors.

Categorised in: General

This post was written by Fred Murigi

Please Subscribe and get Notified when new articles are posted